form 1099 r with distribution code 4 in box 7 Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another . For conductors 4 AWG and larger, you size pull boxes, junction boxes, and conduit bodies per 314.28. That means the minimum dimensions of boxes and conduit bodies must comply with the following: Straight pulls. A conductor that enters one wall of a box and leaves through the opposite wall is a straight pull.

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

$20.79

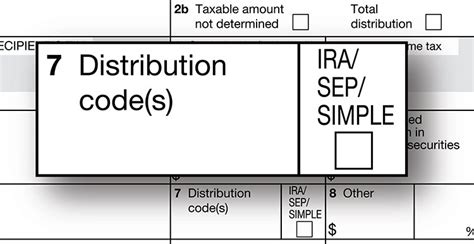

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form .Form 1099-R Box 7 Distribution Codes. Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Additional information: Instructions for Forms 1099-R and .

You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. . Nondisability you enter a code 7 in box 7 of the TurboTax form 1099-R. April 4, 2020 12:02 PM. 0 3,750 Reply. Bookmark Icon. washby . Included as part of the 1099-R form is a space for the distribution code. This code helps to identify what type of distribution is being reported on the form. The distribution codes are as follows: Code 1: Early distribution, no .

One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code(s) to enter in Box 7, Distribution code(s) on IRS Form 1099-R, Distributions From Pensions, . One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following common IRA and QRP . How was Box 7 of your Form 1099-R coded? You should enter each Form 1099-R exactly as shown. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.However, any interest you receive is taxable and you should report it as interest received.

When entering the Distribution Code in Box 7, since the Code is a '4', no further action is necessary upon exiting this menu. When the Distribution Code is a '4,' the 10% Additional Tax for Early Withdrawal does not apply, regardless of the age of the designated beneficiary. NOTE: This is a guide on entering Form 1099-R that has a distribution . A common distribution code used in Box 7 of Form 1099-R is code 7, which indicates a normal distribution. This means that the distribution was made after the account holder reached the age of 59 and a half, and is generally not subject to early withdrawal penalties.Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment Advisor Support; Knowledge Center; . Form 1099-R must be sent no later than January 31 following the calendar year of the distribution. The image below highlights .1099-R Codes for Box 7. Haga clic para español. Revised 01/2024. Box 7 Code. . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age 591/2 .Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportableForm 1099-R, Box 7 codes. Retirement. Form 1099-R, Box 7 codes. The following are the instructions for the 1099-R, Box 7 data entry and what each code means. . If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. .

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? Also noted that when reviewing the screen, "None of the Above" is changed to " distribution before retirement". Is this normal? Review was made by going through update process, not using Back key. I received a 1099-R with Box 7 coded as 4D which is correct it is for an Inherited Annuity Total Distribution. In Federal it asks Where is this Distribution From? Select the Source of this Distribution. I select "None of the above" because it is .

May be eligible for the 10-year tax option method of computing the tax on a lump sum distribution. (See the instructions for Form 4972). 4, 7: B: Designated Roth account distribution. (If an amount is also reported in box 10, see the instructions for Form 5329 and Publication 575.) 1, 2, 4, 7, 8, G, L, M, P, U: C: Reportable death benefits .Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable 1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non .

irs distribution code 7 meaning

A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. IRA owners and qualified retirement plan (QRP) participants who take distributions during a given .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and The distribution codes are found in box 7 of Form 1099-R. The IRA/SEP/SIMPLE box is usually located right next to box 7. . I also have a 100% conversion to Roth from traditional IRA in 2021and the 1099R from Schwab has distribution code 7 in box 7 and IRA/SEP/Simple box with an X. I have tried all the suggestions in this conversation but none .

B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2).

Box 7 is the distribution code, this describes the type of distribution the taxpayer took as known by the payer. The code will help to determine the taxability of the distribution. . Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. There is no code on a 1099-R for nondisabiltiy. You only enter the code in box 7a as is shown on your form. If the code is a 7 with the words Nondisabilty enter a 7 in box 7a. If the code is a 2 with the words Nondisabilty enter a 2 in box 7a.More than 5,000 b. More than 2,000 c. More than 9,000 d. More than 9,000, A lump-sum distribution is reported on Form 1099-R. What is the significance of Box 7 having a code A? a. The distribution is non-taxable. b. The distribution may be eligible for the 10-year tax option method for computing the tax. c. If you were over age 59½ at the time of the return of contribution from the Roth IRA, you must claim an Other reason exception to the early-distribution penalty on the amount shown in box 2a of this Form 1099-R (the earnings). If you were not over age 59½, you owe the early-distribution penalty on the earnings.

You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue.

cnc granite polishing machine

cnc gasket cutting machine for sale

$9.99

form 1099 r with distribution code 4 in box 7|irs distribution code 7 meaning