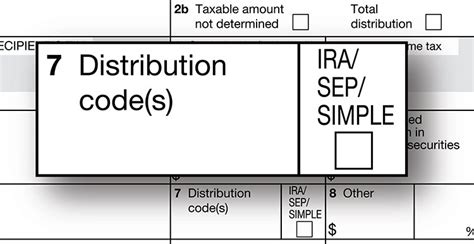

box 7 distribution codes on 1099-r 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

Wiring should be stapled to the wood studs and have splices in accessible junction boxes. Check local electrical codes for specific requirements. There are no issues with modern wiring touching insulation.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

The Premium Hard-Wired Keypad is a 12-key metal access control device. This keypad is weather-resistant and compatible with all hard-wired, non-solar gate openers and electric door locks. It features a die-cast locking aluminum cover, programmable LED keypad lights, and a request-to-exit input.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable.

stainless steel waterproof cabinet

irs distribution code 7 meaning

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .

irs 1099 box 7 codes

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

stainless steel worktop cabinet

Would it be better to use extra cable to feed the 1st downlight on the left and then follow a true radial? Or a junction box (hager j804) close to the feed splitting into the 2 legs? Maybe avoid a junction box as it's an .

box 7 distribution codes on 1099-r|1099 r distribution codes 7d