1099 div box 8 cash liquidation distributions File Form 1099-DIV for each person: •To whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions valued at $10 or more in . The new generation of Crescent Wiss MetalMaster® will cut over 8 miles of steel and feature up to 10 times longer cut life than traditional Aviation Snips. They are available in left/straight cut or right/straight cut.

0 · where to report cash liquidation distribution

1 · is cash liquidation distribution taxable

2 · how to report liquidating dividends

3 · how are liquidating dividends taxed

4 · 1099 div worksheet instructions

5 · 1099 div line 9 instructions

6 · 1099 div form pdf

7 · 1099 div box 9 lacerte

Check out our wooden box with metal corner selection for the very best in unique or custom, handmade pieces from our boxes & bins shops.

For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC.File Form 1099-DIV for each person: •To whom you have paid dividends .

Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. .

Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV. Any .File Form 1099-DIV for each person: •To whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions valued at or more in .

Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these . If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale.

where to report cash liquidation distribution

You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you .

Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule .Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in .

Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV.

is cash liquidation distribution taxable

For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC.

Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV. Any taxable amount the investor receives is reported on Schedule D, the capital gains and losses statement that is filed with the IRS form 1040 during yearly tax filings.File Form 1099-DIV for each person: •To whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions valued at or more in money or other property, •For whom you have withheld and paid any foreign tax on dividends and other distributions on stock,

Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported. If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale.

You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property.

Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment. Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV.For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC.

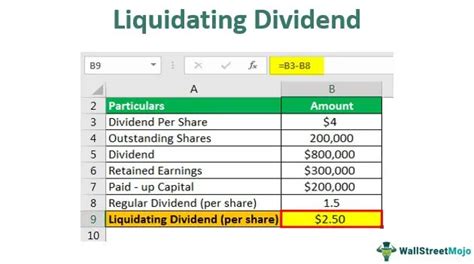

how to report liquidating dividends

Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV. Any taxable amount the investor receives is reported on Schedule D, the capital gains and losses statement that is filed with the IRS form 1040 during yearly tax filings.File Form 1099-DIV for each person: •To whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions valued at or more in money or other property, •For whom you have withheld and paid any foreign tax on dividends and other distributions on stock,

Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported. If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale. You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property.

Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

akro mils steel storage cabinets

akron junction box mount

The Wiska Combi 607/5 (10061778) junction box is made of grey polypropylene and will withstand a temperature range of -30c to 100c. It is suitable for use with cable diameter of a minimum of 3mm to a maximum of 17mm.

1099 div box 8 cash liquidation distributions|1099 div form pdf